In 2025, carbon fiber for racing vs street cars shows clear differences in both design and application. Racing vehicles like F1 and GT3 rely on carbon fiber for extreme weight savings and maximum rigidity, often using prepreg materials and advanced resin systems. Street cars such as the BMW M2 CS or Corvette Z06 favor hybrid carbon fiber constructions for improved durability and cost control. Weight, strength, cost, and durability all play vital roles in determining the best approach for each sector.

Key Takeaways

-

Carbon fiber helps racing cars achieve extreme weight savings and rigidity, boosting speed and safety.

-

Street cars use hybrid carbon fiber designs to balance performance, durability, and cost for daily driving.

-

Advanced manufacturing methods are lowering carbon fiber costs, making it more common in luxury and electric vehicles.

-

Carbon fiber parts last long but need expert repairs, which can increase maintenance and insurance costs.

-

The carbon fiber market is growing fast, driven by innovations and rising demand in both racing and street cars.

Carbon Fiber for Racing vs Street Cars

Weight Savings

Weight savings remain the primary motivation for using carbon fiber for racing vs street cars. Racing teams in Formula 1, GT3, and LMP categories demand the lightest possible vehicles to maximize speed and agility. Engineers select lightweight materials such as carbon fiber composites for nearly every structural and aerodynamic component. In 2025, a typical F1 car uses a carbon monocoque chassis that weighs less than 40 kg, yet provides exceptional rigidity and crash protection. This extreme focus on weight reduction allows racing vehicles to achieve sub-2.3 second acceleration times and top speeds exceeding 300 mph.

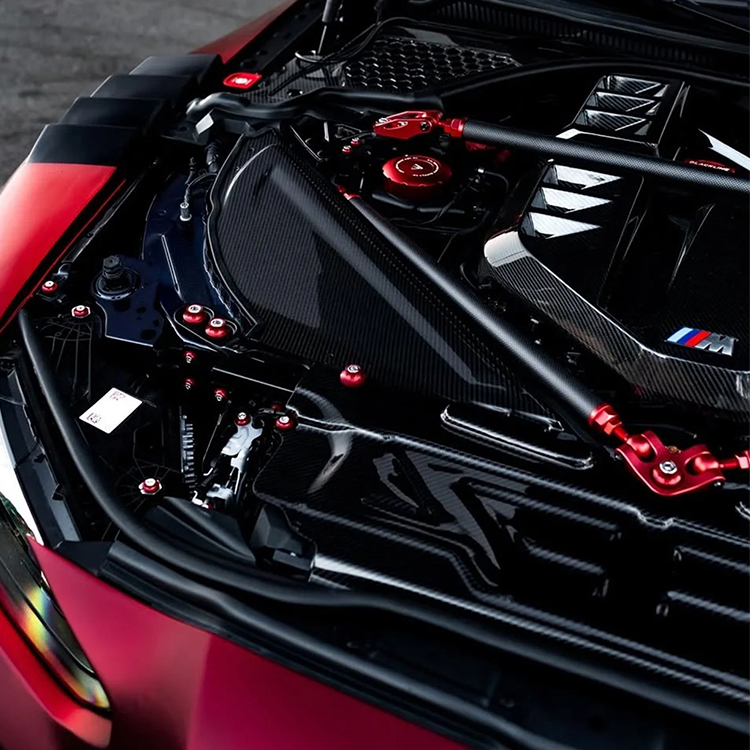

Street cars, including production sports car models like the BMW M2 CS and Porsche GT3, also benefit from carbon fiber, but the approach differs. Manufacturers use carbon fiber for racing vs street cars by balancing weight savings with cost and practicality. For example, the 2025 Porsche Carrera GT adapts racing-derived carbon fiber monocoque technology, but adds reinforcements and hybrid materials to withstand daily driving conditions. Electric vehicles increasingly use carbon fiber composites for chassis and battery housings, improving efficiency and extending driving range.

|

Aspect |

Racing Vehicles |

Street Vehicles / Passenger Cars |

Notes / Trends (2025) |

|---|---|---|---|

|

Weight |

Carbon fiber used extensively for weight reduction due to superior strength-to-weight ratio |

Increasing adoption especially in electric vehicles for weight savings |

Weight reduction critical for performance and EV range extension |

|

Strength |

High strength-to-weight ratio critical for motorsports (Formula 1, NASCAR) |

Used for structural integrity and performance enhancement in luxury and sports cars |

Carbon fiber offers superior mechanical properties compared to traditional materials |

|

Cost |

High production cost limits widespread use; mostly in high-performance and racing cars |

Cost barriers reducing due to manufacturing advancements, enabling broader adoption |

Manufacturing innovations (3D printing, automated fiber placement) expected to lower costs |

|

Durability |

High fatigue resistance required for racing conditions |

Durability enhanced by polymer types (thermoplastic and thermoset) used in composites |

Thermoset polymers offer superior fatigue resistance; thermoplastics dominate market share |

Strength and Performance

The strength and performance advantages of carbon fiber for racing vs street cars stem from its unique structure. Racing vehicles rely on carbon fiber structure for both safety and dynamic capability. The carbon fiber monocoque forms the core of the chassis, providing a rigid safety cell that protects the driver during high-speed impacts. This rigidity also improves handling by increasing chassis stiffness, which allows for more precise suspension tuning and greater downforce generation. Racing cars use advanced prepreg carbon fiber cured in autoclaves, ensuring optimal fiber alignment and resin distribution for maximum strength.

Performance metrics in 2025 highlight these benefits. Racing cars equipped with carbon fiber achieve rapid acceleration, with 0-60 mph times under 2.3 seconds. The lightweight construction and increased rigidity support higher downforce, which enhances cornering grip and stability at speed. Vehicles with over 1,500 horsepower depend on carbon fiber to manage power delivery and maintain structural integrity.

In contrast, production sports car manufacturers use carbon fiber to enhance both performance and safety, but with broader considerations. The carbon fiber monocoque in a street car like the Carrera GT integrates the windshield frame and rollover structures, blending racing technology with road safety standards. Street vehicles often combine carbon fiber with other materials, such as Kevlar, to improve crash resistance and durability. The result is a car that delivers improved handling, moderate weight reduction, and enhanced aesthetics, while remaining practical for daily use.

|

Performance Metric |

Relation to Carbon Fiber Strength and Properties |

|---|---|

|

Acceleration (0-60 mph) |

Carbon fiber’s lightweight and rigidity contribute to sub-2.3 second times, enhancing quickness and responsiveness. |

|

Top Speed (>300 mph) |

Strength and weight reduction from carbon fiber enable higher top speeds by improving power-to-weight ratio and vehicle stability. |

|

Weight Reduction (~300 lbs) |

Use of carbon fiber body panels reduces overall vehicle weight, directly improving acceleration and handling. |

|

Rigidity |

Increased chassis stiffness from carbon fiber improves handling dynamics, allowing better control at high speeds. |

|

Horsepower Benchmark |

Vehicles with at least 1,500 hp leverage carbon fiber strength to manage power delivery and maintain structural integrity. |

Construction Differences

Construction techniques for carbon fiber for racing vs street cars reflect different priorities. Racing vehicles prioritize maximum stiffness, minimal weight, and aerodynamic optimization. Engineers use advanced prepreg materials, hand layup, and autoclave curing to create components with precise fiber orientation. These methods produce lightweight, rigid parts that maximize downforce and aerodynamic efficiency. Racing cars often feature a carbon composite underbody and adjustable spoilers, both designed to optimize aerodynamics and downforce at high speeds.

Production sports car manufacturers adapt these technologies for road use, but modify them for durability and cost-effectiveness. The 2025 Porsche Carrera GT, for example, uses a carbon fiber monocoque chassis with aluminum and steel inserts at key points to improve crash safety and structural integrity. Street car components often include Kevlar plies to prevent shattering in accidents. Manufacturers use a combination of autoclave prepreg layup and resin transfer molding to balance performance with production scalability.

-

Racing carbon fiber parts:

-

Maximum stiffness and minimal weight

-

Advanced prepreg materials, autoclave curing

-

Focus on aerodynamics and downforce

-

Low-volume, hand-crafted production

-

-

Street car carbon fiber parts:

-

Hybrid construction for durability

-

Aluminum and steel inserts for safety

-

Kevlar layers for crash resistance

-

Combination of autoclave and resin transfer molding

-

Tightly controlled tolerances using CNC machining

-

The use of carbon fiber for racing vs street cars continues to evolve. In 2025, manufacturers invest in new resin systems, improved fiber weaves, and advanced manufacturing techniques to enhance both performance and safety. The growing market for carbon fiber in electric vehicles and production sports car models signals a shift toward broader adoption of lightweight materials, with a focus on balancing downforce, aerodynamics, and everyday usability.

Cost

Material and Manufacturing

In 2025, carbon fiber remains a premium material in automotive manufacturing. Racing cars such as F1 and GT3 models use high-grade carbon fiber composites, often produced with prepreg materials and autoclave curing. These processes deliver maximum strength and minimal weight, but they also drive up costs. Carbon fibers account for about 75% of the total composite material cost in automotive applications. Traditional production methods require significant energy, making them expensive. A Germany-based plant reported a carbon fiber reinforced plastic (CFRP) production cost of approximately $2,499 USD per unit in early 2025.

Manufacturers have started to adopt new techniques like resin transfer molding (RTM), automated fiber placement (AFP), and compression molding. These innovations gradually reduce production costs and make carbon fiber more accessible for higher-volume street vehicles, such as the BMW M2 CS or Corvette Z06. However, high costs and limited recycling infrastructure still restrict widespread use in lower-priced cars.

Note: Manufacturing costs remain a significant barrier, so most carbon fiber applications appear in luxury, performance, or racing vehicles.

Repair and Maintenance

Carbon fiber components offer excellent strength and resistance to rust, which benefits both racing and street cars. However, repairs require specialized technicians and equipment. Minor damage can be fixed, but severe impacts often mean replacing the entire part. This process costs more than repairing traditional steel components. Owners must visit authorized service centers with experience in carbon fiber repairs to ensure proper handling.

-

Specialized tools and skills increase repair costs.

-

Insurance premiums tend to be higher for vehicles with carbon fiber parts.

-

Regular cleaning and inspection help maintain appearance and structural integrity.

Street cars with carbon fiber panels face similar challenges. While the material improves longevity, the need for expert repairs adds to overall maintenance expenses.

Resale Value

Vehicles equipped with carbon fiber components often retain higher resale values, especially in the luxury and performance segments. Buyers recognize the benefits of reduced weight, improved performance, and modern aesthetics. However, potential buyers may also consider the higher repair costs and insurance premiums. In racing cars, carbon fiber construction signals top-tier engineering, which can boost desirability and value in the secondary market. For street cars, resale value depends on the condition of the carbon fiber parts and the reputation of the manufacturer.

Durability

Wear and Tear

Racing cars such as F1 and GT3 models experience extreme mechanical stress during each event. Engineers select high-grade prepreg carbon fiber with tightly controlled resin content and advanced weave patterns to withstand repeated high-speed loads. These materials resist fatigue and microcracking, even after multiple race cycles. Teams inspect and replace panels frequently to maintain peak condition.

Street cars like the BMW M2 CS or Porsche GT3 face different challenges. Daily driving exposes carbon fiber parts to UV rays, temperature changes, and minor impacts. Manufacturers use hybrid composites, often combining carbon fiber with thermoplastic resins, to improve resistance to scratches and environmental degradation. Owners benefit from lighter panels that resist rust and corrosion, but must avoid harsh chemicals during cleaning.

Tip: Regular inspections and gentle cleaning help extend the lifespan of carbon fiber components on both racing and street vehicles.

Crash Resistance

Crash resistance remains a critical factor for both racing and street applications. In racing, the carbon fiber monocoque acts as a protective shell, absorbing and dispersing energy during high-speed impacts. Experimental testing, including low velocity impact and compression after impact studies, shows that carbon fiber reinforced polymer composites deliver superior energy absorption and damage tolerance. These materials maintain structural integrity even under challenging conditions, such as low temperatures found in Arctic environments. Engineers rely on precise fiber orientation and resin systems to maximize safety without adding unnecessary weight.

Street cars use similar technology, but manufacturers often reinforce carbon fiber with additional materials like Kevlar or aluminum inserts. This approach improves crash performance while meeting road safety regulations. The result is a vehicle that protects occupants effectively during collisions, with panels that resist shattering and maintain shape.

Lifespan

The lifespan of carbon fiber components depends on usage and construction. Racing teams replace parts regularly to ensure maximum reliability and safety. High-quality prepreg carbon fiber can endure multiple race seasons if maintained properly, but teams rarely risk using older components in competition.

Street vehicles benefit from advances in resin chemistry and hybrid construction. Modern carbon fiber panels can last the lifetime of the car when protected from severe impacts and environmental damage. Manufacturers offer warranties on carbon fiber parts, reflecting confidence in their durability. Owners who follow recommended care routines can expect these components to outlast traditional steel or aluminum panels.

Practicality

Availability

Manufacturers in 2025 offer a wide range of carbon fiber components for racing vehicles. Teams can purchase body packages, front and rear clips, doors, spoiler wings, and deck lids for popular models like the Chevrolet Camaro, Ford Mustang, and Dodge Dart. These parts come in several material options, including advanced lightweight composites and ultralight carbon fiber. The following table highlights the diversity and pricing of available racing components:

|

Vehicle Model |

Component Type |

Material Options |

Starting Price (USD) |

|---|---|---|---|

|

Chevrolet Camaro |

Pro Stock Body |

Carbon Fiber, Ultralight Carbon Fiber |

$11,386 |

|

Ford Mustang |

Pro Stock Body |

Carbon Fiber, Ultralight Carbon Fiber |

$11,185 |

|

Dodge Dart |

Pro Stock Body |

Carbon Fiber, Ultralight Carbon Fiber |

$8,775 |

|

Chevrolet Camaro |

Front Clips |

Carbon Fiber, Ultralight Carbon Fiber |

$3,484 |

|

Ford Mustang |

Doors |

Carbon Fiber, Ultralight Carbon Fiber |

$1,011 |

|

Dodge Dart |

Deck Lids |

Carbon Fiber, Ultralight Carbon Fiber |

$210 |

Street vehicles, in contrast, have limited direct access to carbon fiber parts. Most manufacturers reserve these materials for high-performance or luxury models. Aftermarket options exist, but they rarely match the variety or engineering precision found in racing applications.

Repairability

Repairing carbon fiber requires specialized skills and equipment. Racing teams rely on experienced technicians who use visual inspections, coin tap tests, and ultrasound to detect damage. They often patch damaged areas with heat lamps or silicone heater blankets. Over the years, motorsport teams have repaired rather than discarded many carbon fiber parts, proving the material’s practical repairability.

-

Technicians use advanced inspection methods to assess damage.

-

Teams patch and cure components using controlled heat.

-

High-end street vehicles sometimes replace non-structural parts, but new repair strategies are emerging for critical components.

These evolving techniques help reduce costs and waste, especially as carbon fiber becomes more common in both racing and street vehicles.

Insurance

Insurance for vehicles with carbon fiber parts presents unique challenges. The complexity of repairing carbon fiber increases claim expenses. Insurers recognize that specialized repair techniques drive up costs, which often leads to higher premiums for owners of both racing and high-end street cars.

-

Carbon fiber improves safety but complicates repairs.

-

Specialized repair methods increase overall claim costs.

-

Insurers and repair shops must adapt to these changes in material technology.

Drivers considering carbon fiber should weigh these insurance implications alongside the performance and durability benefits.

Carbon Fiber Trends 2025

Market Adoption

The automotive industry continues to accelerate its use of carbon fiber in 2025. The global market is projected to reach $6.5 billion, with a compound annual growth rate of 11.3% through 2034. Companies such as Tesla, BMW, Ferrari, and McLaren have expanded carbon fiber integration into both mass-market and high-performance vehicles. This growth is driven by the need for lightweight, high-strength parts that improve fuel efficiency and performance. The electric vehicle sector now accounts for over 40% of demand, as manufacturers seek to offset battery weight and extend driving range. Regional adoption varies, with Asia-Pacific leading at 38%, followed by Europe and North America.

A shift toward thermoplastic composites is underway, offering faster production and better recyclability. Thermosetting carbon fiber holds about 55% of the market, while thermoplastics rapidly gain ground due to their efficiency and sustainability.

New Technologies

Automotive manufacturers have adopted several new technologies to improve carbon fiber production and application:

-

Automated production techniques, including robotics and advanced machines, increase speed by 25% and reduce waste.

-

Sustainable methods use bio-based precursors and energy-efficient processes, lowering environmental impact.

-

Recycling innovations enable recovery of carbon fiber with up to 93.6% of its original tensile strength, supporting a circular economy.

-

3D printing and additive manufacturing allow for complex geometries and improved mechanical properties in carbon fiber composites.

These advancements make carbon fiber more accessible for both racing and street cars, enhancing performance, durability, and sustainability.

Future Outlook

Industry forecasts predict strong growth for carbon fiber through 2032, with the market expected to reach $64.05 billion. Racing applications will continue to lead in innovation, with companies like Porsche developing lighter, safer carbon fiber safety cages. Street cars will see broader adoption as costs decrease and recycling infrastructure improves. However, challenges remain, including high production costs and limited mass-market penetration. The industry’s focus on sustainability and new manufacturing methods will shape the evolving role of carbon fiber in automotive design.

The 2025 data highlights rapid growth in the carbon fiber market, with projections reaching $23.2 billion by 2033 and annual demand rising over 11%. The following table summarizes key outcomes:

|

Key Numerical Outcomes |

Details |

|---|---|

|

Market Value (2033) |

$23.2 billion |

|

CAGR |

10.8%–12.6% |

|

Weight Reduction |

>30% |

|

Strength-to-Weight |

Superior to aluminum alloys |

For racers, carbon fiber for racing vs street cars delivers unmatched weight savings and rigidity, making it essential for performance and safety. Street car owners benefit from improved efficiency and aesthetics, but higher costs and repair complexity remain. Alternatives may suit daily drivers seeking lower expenses and easier maintenance. Each driver should weigh performance needs, budget, and future trends before investing in carbon fiber technology.

Share:

Why Carbon Fiber Is the Backbone of Modern F1 Cars

How Carbon Fiber Motorsport Applications Enhance Aerodynamics and Handling